Dollar (USD) to Naira black market rate today -18th August, 2022

Dollar (USD) to Naira black market rate today -18th August, 2022

Hello there,

You probably must have come around to check the current price of Dollar to Naira for today 18th of August, 2022 at black market (Parallel market). The good thing is we already have everything in stock and updated as you could keep checking every day, also, we’d be displaying the price of pound sterling (The oldest currency) to Naira and Euro (the currency of the European Union countries and adopted by 19 countries including Austria, France, Cyprus, Spain, Italy, Ireland, Portugal and so on) to Naira.

Most Nigerians do prefer that they change their Dollar, Pounds or Euro at black market because the rate to Naira is always high compare. So, we’d look at the price of Dollar to Naira at the black market and Aboki fx. How much is it today, 18th of August, 2022. If you won’t mind as your answer is already down the page, you might want to know how the Dollar to naira exchange rate got to this point. Did you now that in 1972 when Naira was for the first time produced, it was higher than dollar? Did you know that the dollar to naira exchange rate skyrocketed from 0.067 (not up to 1 naira) in 1982 to become 17.30 naira in 1993? Our source WIKIPEDIA also makes us realize as it is in the picture below that the second blow hot event that led to another devaluation of Naira was in 1999 where according to the Statistics in the attach image after the paragraph, reads 21.89 naira to one dollar and the year that follow 2000! In the first year of the 21st century, the Dollar to naira exchange got out of hand recording 85.98 naira to one dollar.

subsequently, it keeps increasing even through-out president Goodluck Jonathan’s time and got totally worst in President Mohammed Buhari’s era. At a time, last month, the dollar was record to go as high as 710 before it came back to 418.69 central bank of Nigeria rate.

The above is to give you an insight on how it started and how we got here, because currently naira has really lost it value in international space and even in domestic market (things you can buy within the country). So, what helps most is to earn in dollar. Earning in dollar means you’d convert it to naira before you can spend it, this is where the exchange rate comes in, the parallel market has better rate than the central bank rate. Black market according to Investopedia is “an economic activity that takes place outside government-sanctioned channels. Illegal market transaction usually occurs ‘under the table’ to let participants avoid government price control or taxes”. This is to tell you that the Parallel or black market is not recognised and it’s illegal, albeit, it has good rate compare to FG and it monitor the excesses or irregularities of the federal government.

Dollar to Naira Black Market Rate today 18th of August, 2022

Dollar to Naira (USD to NGN) black market exchange rate today

Pound Sterling to Naira (GBP to NGN) black market exchange rate today

Euro to Naira (EUR to NGN) black market exchange rate today

Dollar (USD) – Black Market Selling price : 685 Pound Stelling – Black Market Selling Price :816 Euro – Black Market Selling price : 687

Dollar (USD) – Black Market Buying Price: 680 Pound Sterling – Black Market Buying Price :807 Euro – Black Market Buying Price : 674

Don’t forget that prior 1972, Nigeria spend kobo and Pounds, the image below shows the look of old Nigeria 1 Pounds and series of kobo.

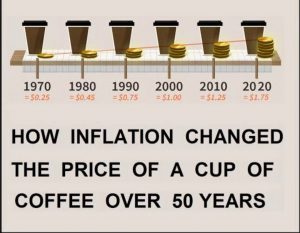

The question is what is are the basic factors affecting foreign exchange rate or the fluctuation of currency, making one has buying power than the other. The reasons are numbered and the main is inflation.

Inflation according to Wikipedia “is a general increase in prices of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, Inflation correspond to a reduction in the purchasing power of money”. What this means is that the amount you buy 1 bag of rice at 10k in 2004, that same 10k cannot buy same again because the bag of rise is now 15k in 2007, if the 10k in Nigeria it means the amount we will get any imported goods too will rise because international company won’t want to get underpaid, this circle continues making the much naira equal to fewer amount outside. The logic is things are already cost in the country making people pay more, any international company in other to make their profit won’t go low but rather, they’d look at the current amount, what it could get them in their own currency and set price. N.B Inflation is universal, almost every country of the world has experience inflation in one way or the other before. The different between Nigeria and these countries is they’re controlling it while Nigeria government only commit little effort in controlling rather politics is the order of the day. Although, the fault is totally not with government as individual also has their part to play, the reduction in exportation and more importation devalues naira even more. To control this Nigerians should start investing in agricultural product and some other produce which will be ready for export abroad and Nigeria should change the mentality of importing every single thing and start embracing domestic products. Even US has gone through inflation has seen in the picture of cup of coffee below which as at 1980 was 0.45 dollar and in 2010 has become 1.25 dollars. Dollar also lose buying power but the regulatory mechanism is there and you won’t really see the wide gap unlike naira has seen above.

The first best way to provide solution to the problem of exchange rate in Nigeria is to work on the causes, after that you’d see the rest is few. The causes include :

1. Low production of domestic food stuffs: E.g. yam, rice, plantain, etc. This is due to many problems like poor climate conditions inadequate labour supply, persistent pest infection and inadequate supply of basic inputs (e.g. fertilizers, and harvests). Demand is thus in excess of supply leading to a persistent pest in prices of foodstuffs.

2. Increased government deficit financing: Increased government budget deficit financing, in a bid to provide more development projects has led to too much money in the economy. This strengthens people’s purchasing power and, where goods

and services are in short supply, the general price level rises.

3. Low productivity in the industrial sector: This results in low supply of manufactured

goods. This could be brought about by high costs of production and, consequently, high prices of manufactured goods ensue.

4. Wages and salaries in excess of productivity: There is excessive increase in the earnings of all categories of labour relative to productivity thus leading to “too much money chasing too few goods. “e.g. the Udoji Award in Nigeria in 1975 by which b wages and salaries were revised upwards is believed to have created an inflationary trend in Nigeria.

5. Poor distributive system: Poor or lack of adequate transporter facilities leads to shortages of goods at places where they are most needed. Supply thus falls short of demand, leading to high prices.

6. Deficiency in the storage system: Lack of facilities for storing supply, leads to many goods getting perished and hence reducing supply. Where demand continuously rise, prices inevitably rise persistently.

We’d like you do come around for more update on exchange rate and Economy topics like this, have a nice time.